SERVICES

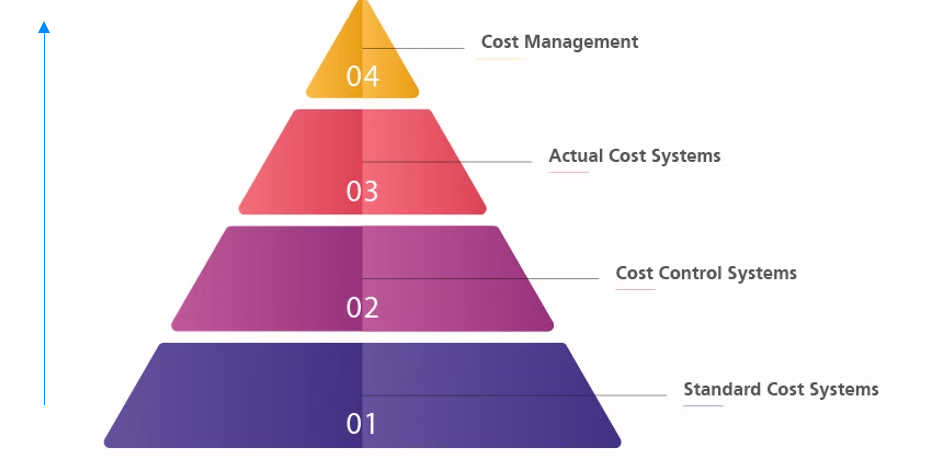

2-1 Pricing Systems

• Make informed pricing decisions.

4-1 Actual Costing Systems

1- Establishing systems for strategic cost management and pricing, which include the following:

1.1 Standard Costing Systems

• Providing an accurate view of service costs.

• Calculating the standard consumption rate for each product (raw materials – time)

• Determining cost allocation policies and loading rates.

• Use the latest costing systems, such as T.D.A.B.C.

• Apply the latest target costing systems

3-1 Cost Control Systems

• Monitor cost elements at each operational/production stage

5-1 Sensitivity and Variance Analysis

• Evaluate variances at the cost center level.

• Make corrective decisions to achieve a competitive advantage.

1- Establishing systems for strategic cost management and pricing, which include the following:

1.1 Standard Costing Systems

• Providing an accurate view of service costs.

• Calculating the standard consumption rate for each product (raw materials – time)

• Determining cost allocation policies and loading rates.

• Use the latest costing systems, such as T.D.A.B.C.

• Apply the latest target costing systems

2-1 Pricing Systems

• Make informed pricing decisions.

3-1 Cost Control Systems

• Monitor cost elements at each operational/production stage

4-1 Actual Costing Systems

5-1 Sensitivity and Variance Analysis

• Evaluate variances at the cost center level.

• Make corrective decisions to achieve a competitive advantage.

2- Purchasing and Inventory Systems and Control Systems for Each:

1-2 Purchasing and Inventory Systems

• Document cycle (paper and electronic).

• Preparing an implementation manual.

• Preparing a supplier receipts manual in both Arabic and English.

2-2 Purchasing and Warehouse Control Systems

• Documentation cycle (paper and electronic).

• Preparing an implementation manual.

• Preparing a model for analyzing deviations from planned systems (quantity and value).

3-2 Internal Reporting Systems

• Preparing periodic monitoring and feedback reports to promote continuous improvement.

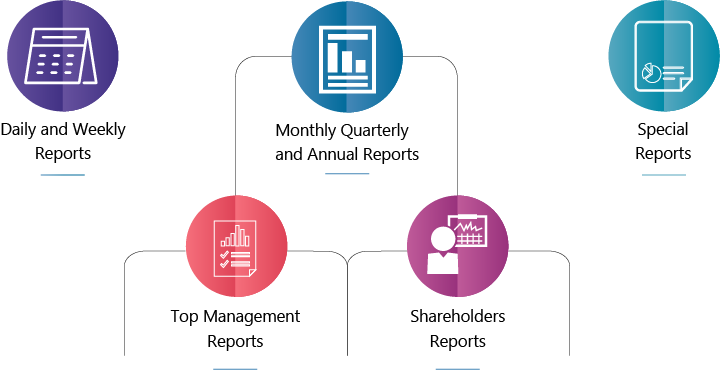

3- Establishing periodic and special reporting systems

1-3 Periodic Reporting Systems

a. Reports by Management Level:

• Reports to shareholders and senior management.

• Reports to executive management and other departments.

• Reports to departments and operational and production supervisors.

b. Reports by Periodicity:

• Monthly and quarterly reports.

• Weekly and monthly reports.

• Daily and weekly reports.

2-3 Special Reporting Systems

• Preparing reports to support strategic decision-making and measure their impact on profitability at the departmental, service, and product levels, as well as at the company level as a whole.

• Example: Crisis management reports and impact assessment.

Implementation steps:

• Designing templates: Measuring report quality through its support for decisions, while balancing detail, timeliness of presentation, and accuracy of content.

• Pilot implementation.

• Final implementation.

• Preparing a policy and procedure manual detailing responsibilities and confidentiality of presentation.

![pyr_chart [Recovered]-03](https://growxcel.com/wp-content/uploads/2025/05/pyr_chart-Recovered-03.png)

4- Supporting financial management for management accounting purposes

- Example:

• Chart of accounts: Alignment with the cost center tree.

• Accounting guidelines: Alignment with strategic cost analysis purposes.

• Systems for implementing accounting and auditing, their periodicity, and schedule.

• Internal reporting systems: Policies, procedures, and degree of detail.

• Improving output efficiency: Supporting the accuracy of information to align with target systems.

5- Preparing operating budgets

-

What is the importance of the operating budget?

-

The operating budget is a company-wide roadmap, providing a clear vision of targeted profits during the planned period, both at the level of general business results and through detailed methods for achieving these goals. These dimensions include:

-

At the level of departments and divisions.

-

At the item level (products or services).

-

Weekly, monthly, quarterly, or semi-annually.

-

-

-

The budget provides a clear vision of the anticipated steps before implementation begins. It requires studying the expected impact on the targeted profitability and identifying the necessary steps in detail. It also includes a plan that illustrates the expected impact to ensure optimal utilization of available resources.

-

Components of the Operating Budget

• The operating budget includes:

o Optimal selection of the sales mix.

o Determining target profits at the item, department, and company levels.

o Making feedback decisions to ensure optimal utilization of expenditures.

o Reducing waste levels while determining the optimal time for decision-making and implementation.

-

1-Supporting the implementation of global ERP systems (e.g., SAP or Oracle “Implementation Support”)

- Whether by:

1-Developing an existing ERP system

2-Building and implementing a new ERP system

3-Creating a dedicated cost unit (Access or Excel)